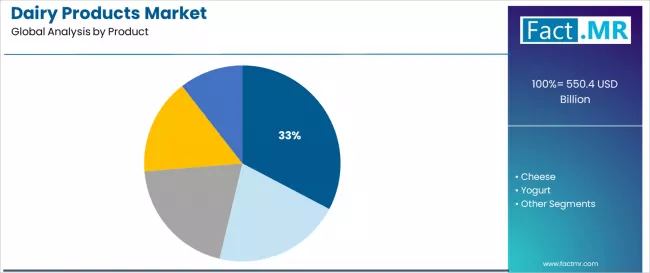

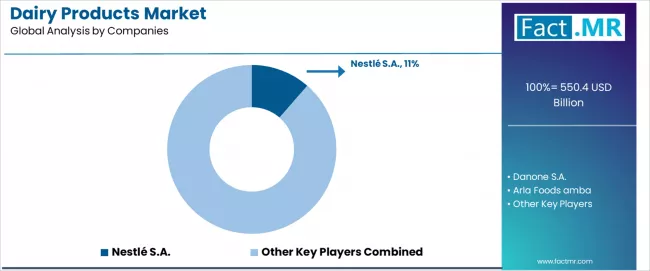

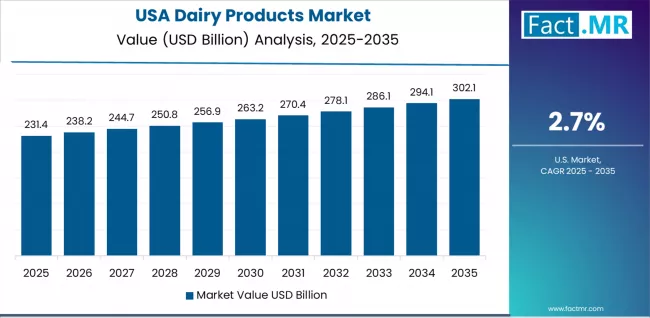

According to Fact.MR analysts, the global dairy market is valued at $550.4 billion in 2025 and is projected to grow to $720.6 billion by 2035. The compound annual growth rate (CAGR) for 2025–2035 is estimated at 2.7%, representing an increase of more than $170 billion over the decade.

Growth is supported by rising demand for protein nutrition, expansion of value-added products, investment in cold-chain infrastructure, and the adoption of modern dairy processing technologies.

Key Market Drivers

- Increased focus on protein, calcium, and functional nutrition;

- Urbanization and the expansion of modern retail in developing countries;

- Strategic market expansion through supermarket chains;

- Packaging innovation and investment in specialized dairy processing facilities.

At the same time, restraining factors include lactose intolerance, competition from plant-based alternatives, and volatility in raw material prices.

Market Structure by Product

Milk — 32.7% of the market (2025)

Milk remains the largest category due to mass consumption and affordability. Skimmed and low-fat variants account for a significant share (over 40% of the category).

Cheese — 26.3% in 2025 → 27.1% in 2035

Cheese shows steady growth, particularly driven by culinary applications and the development of processed cheese products. Processed cheese accounts for approximately 46.0% of the segment’s value.

Yogurt — 18.4% in 2025 → 19.5% in 2035

Demand is driven by probiotic and functional formats. Flavored and drinkable yogurts account for more than half of the segment.

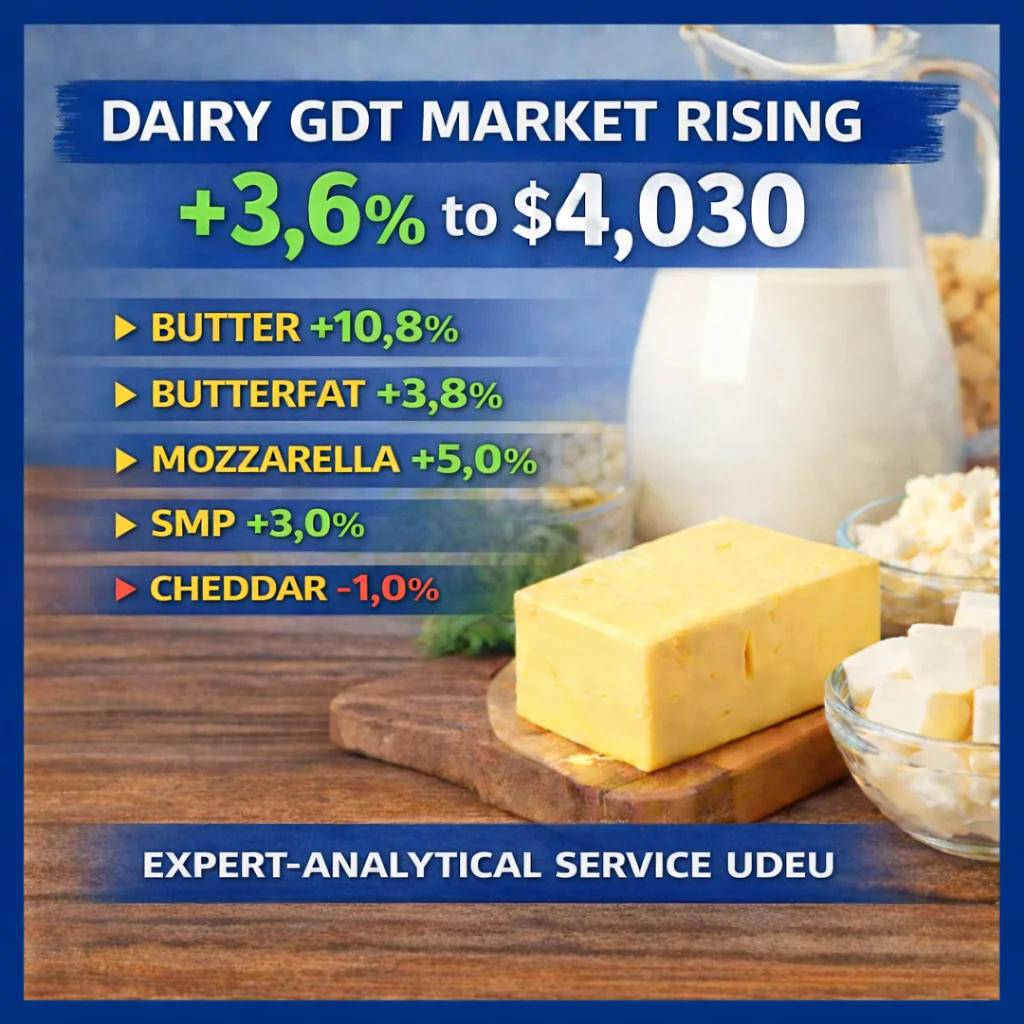

Butter — 14.2%

The largest share belongs to unsalted butter (over 50%).

Distribution Channels

- Supermarkets/Hypermarkets — 60.2% of the market (key channel);

- Convenience stores — 18.6%;

- Online sales — the fastest-growing channel (from 12.3% to 17.5% by 2035).

The rapid expansion of e-commerce is driving investment in cold-chain logistics and direct-to-consumer models.

Regional Trends

- Europe — 31.9% of the market (volume leader);

- Asia-Pacific — 30.8% (most dynamic region);

- North America — focus on premium products and protein fortification.

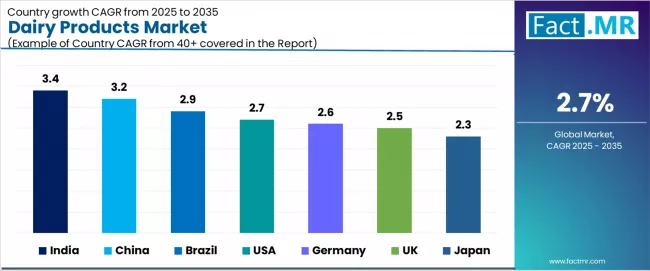

Countries with the Highest Forecast Growth (CAGR)

- India — 3.4%

- China — 3.2%

- Brazil — 2.9%

- United States — 2.7%

- Germany — 2.6%

- United Kingdom — 2.5%

- Japan — 2.3%

Competitive Landscape

The market is moderately concentrated: the top three companies control 30–35% of the global share.

Among the leaders:

- Nestlé

- Danone

- Arla Foods

- Fonterra

- FrieslandCampina

- Kraft Heinz

- Dairy Farmers of America

Competition is based on quality, innovation, cold-chain efficiency, and brand trust.

How Is India Leading Global Dairy Market Growth?

India is projected to post the highest compound annual growth rate among major dairy markets — 3.4% CAGR through 2035. This trajectory is underpinned by several structural factors.

First, the country is the world’s largest milk producer, providing a strong raw material base for both domestic consumption and further processing.

Second, value-added segments are expanding rapidly — including yogurt, flavored milk, packaged formats, and traditional dairy desserts. This enhances industry margins while meeting the evolving demand of the growing urban middle class.

Geography of Growth

Expansion is concentrated in major production and consumption hubs:

- Gujarat

- Punjab

- Uttar Pradesh

- Maharashtra

In these regions, cooperatives and private processors are actively implementing modern technologies and developing new product formats.

Institutional Support

A key role is played by the National Dairy Development Board (NDDB), which supports:

- modernization of production;

- implementation of quality standards;

- development of the cooperative model.

Government initiatives building on the legacy of Operation Flood continue to stimulate milk production and expand processing capacity.

Key Growth Drivers

- large-scale expansion of dairy cooperatives;

- government production incentives;

- a well-developed supply ecosystem;

- active integration of new product formats: flavored milk, packaged yogurt, traditional dairy sweets;

- coexistence of organized retail with India’s traditional milk distribution system.

What Makes China One of the Most Dynamic Dairy Markets?

China is projected to grow at a 3.2% CAGR through 2035, positioning it as a key driver of global dairy industry expansion.

Urbanization and Changing Consumption Patterns

In major metropolitan areas — Beijing, Shanghai, Guangzhou, Shenzhen — dairy consumption is rising steadily due to:

- expansion of modern retail chains;

- rapid growth of e-commerce;

- modernization of the cold chain;

- gradual westernization of dietary habits.

Urban households are becoming the primary demand drivers, particularly in the chilled product segment.

Focus on Protein and Functionality

Chinese consumers are increasingly oriented toward:

- probiotic yogurts;

- functional dairy beverages;

- premium formats with enhanced nutritional value;

- protein-rich products supporting overall health.

The expansion of yogurt consumption is one of the principal growth engines of the market.

Government Policy and Food Safety

The Healthy China Initiative supports demand for high-quality dairy products. At the same time, stricter food safety standards are accelerating the shift toward branded products manufactured by large-scale processors.

Key Development Factors

- dominance of modern retail in major cities;

- significant investment in cold-chain infrastructure;

- technological partnerships between international and domestic companies;

- development of shelf-stable (ambient) formats and fortified products.

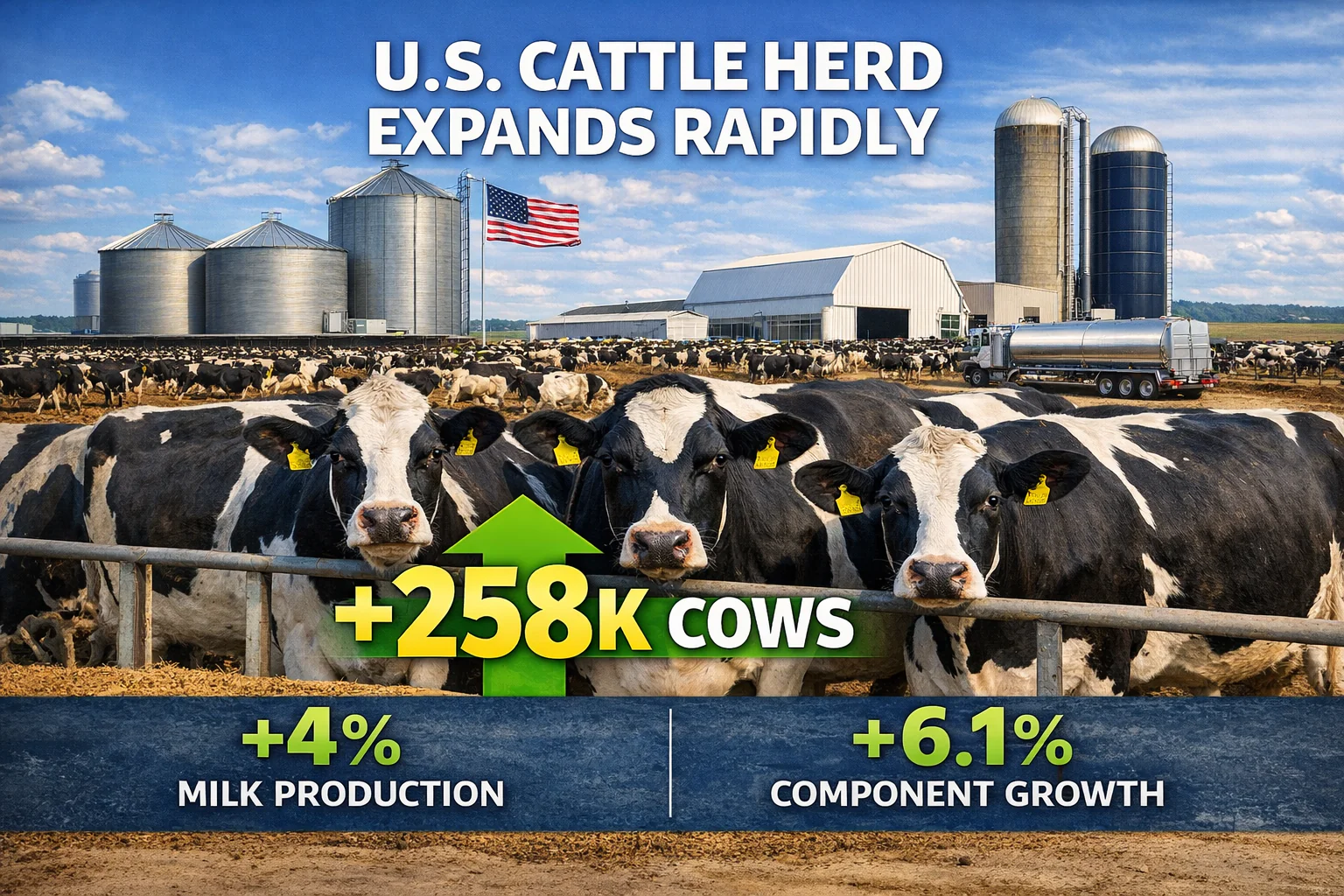

How the United States Demonstrates Leadership in the Premium Dairy Segment

The U.S. dairy market is projected to grow at a 2.7% CAGR through 2035, in line with global dynamics, but distinguished by a strong emphasis on premiumization and functionality.

Premium Positioning and Organics

Growth is driven by diversified consumer demand, including:

- rapid expansion of organic dairy products;

- growth of milk protein and high-protein formats;

- rising demand for grass-fed and certified products;

- strengthening positions of specialized grocery retailers.

Premium dairy products continue to show stable annual sales growth across major retail chains.

Focus on Protein and Sports Nutrition

Heightened attention to protein intake, along with dietary guidance from the United States Department of Agriculture, supports demand for dairy as a source of complete protein.

The fastest-growing segments include:

- sports nutrition;

- recovery beverages;

- protein-enriched yogurts and cheeses.

Milk protein is increasingly positioned as a key ingredient for muscle recovery and improved physical performance.

Lactose-Free and Clean-Label Solutions

Growing demand for lactose-free products is prompting processors to invest in:

- advanced lactose-free processing infrastructure;

- innovative formulations;

- clean-label positioning;

- sustainability programs.

Key Market Characteristics

- strong development of specialized retail channels;

- expansion of organic and grass-fed segments;

- continued investment in lactose-free technologies;

- emphasis on nutritional value and competitiveness of CPG products.

Why Germany Is a Model of Innovation in the Organic and Lactose-Free Segments

Germany is one of Europe’s leaders in implementing organic production standards and advancing lactose-free technologies. The market is projected to grow at a steady 2.6% CAGR through 2035, supported by systematic modernization across the sector.

Integration of Organics and Technology

Development is driven by:

- large-scale expansion of organic dairy farming;

- adoption of enzyme-based technologies for lactose-free production;

- integration of environmental standards with advanced processing solutions.

Key regions — Bavaria, Lower Saxony, North Rhine-Westphalia, and Baden-Württemberg — serve as hubs for modernization in organic dairy production.

Demand for Sustainable and Transparent Products

German consumers actively prefer:

- certified organic products;

- environmentally responsible formats;

- products with full traceability of origin;

- lactose-free solutions for specific dietary needs.

A high level of consumer trust is reinforced through close cooperation between retailers and certification bodies.

Structural Market Features

- ongoing modernization projects in organic dairy farming;

- partnerships between cooperatives and processors;

- expansion of lactose-free product lines;

- strong role of supermarkets and specialized organic retail outlets.

What Is Driving the Growth of Hybrid Dairy Products in the United Kingdom?

The United Kingdom’s dairy market is projected to grow at a steady CAGR of 2.5% through 2035. One of the most prominent growth drivers is the expansion of dairy–plant hybrid formats that combine traditional dairy ingredients with plant-based components.

Urbanization and Retail Modernization

In major cities such as London, Manchester, and Birmingham, retail chains are actively redesigning dairy aisles by introducing:

- expanded assortments of reduced-fat products;

- hybrid dairy–plant formats;

- solutions tailored to flexitarian consumers.

Retailers are optimizing shelf space and category structures to address demand for more flexible and health-oriented dietary options.

Shifting Consumer Preferences

UK consumers are increasingly choosing:

- lower-fat dairy products;

- combinations of dairy protein with plant-based ingredients;

- options aligned with environmental and health-conscious values.

This trend does not signal a rejection of dairy. Rather, it reflects an adaptation of dairy to evolving dietary models and sustainability considerations.

Infrastructure and Strategic Partnerships

Market development is supported by:

- a strong national dairy processing infrastructure;

- strategic partnerships between dairy brands and plant-based ingredient suppliers;

- active category management programs implemented by major supermarket chains.

How Does Japan Maintain Leadership in Functional Dairy Beverages?

Japan’s dairy market is projected to grow at a steady CAGR of 2.3% through 2035, with a strong emphasis on functionality and precision nutrition. The primary focus is on probiotic dairy beverages integrated into daily routines that support digestive health and longevity.

Key Drivers:

- an aging population and rising demand for preventive nutrition;

- strong presence of functional beverages in supermarkets and vending machines;

- partnerships between dairy companies and probiotic research centers;

- strict safety standards and rigorous quality control;

- controlled-portion formats with clearly communicated health benefits.

The regions of Kantō region, Kansai region, Chūbu region, and Kyushu serve as innovation hubs in the functional dairy segment.

What Is Driving Growth in Dairy Consumption in Brazil?

Brazil is projected to record a CAGR of 2.9% through 2035, supported by the expansion of the middle class and growing demand for protein-rich foods.

Key Growth Factors:

- modernization of supermarkets in São Paulo, Rio de Janeiro, Brasília, and Belo Horizonte;

- development of cold chain infrastructure and regional logistics;

- partnerships between international brands and local distributors;

- popularity of UHT milk and convenient storage formats;

- rising consumer interest in premium and branded dairy products.

Dairy products are increasingly positioned as an affordable source of protein for urban households, supporting sustained long-term market growth.

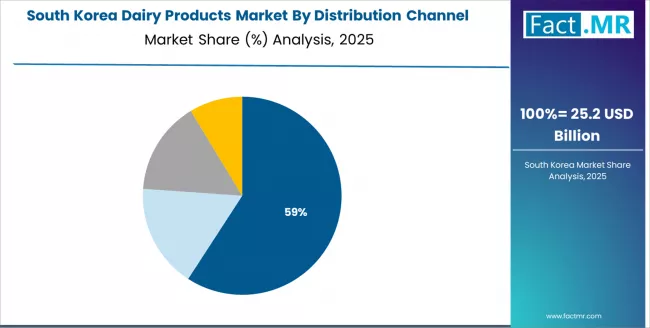

What Defines the Leadership of Dairy Processors in South Korea?

The South Korean dairy market is characterized by intense competition between international and domestic players. Leading companies, including Danone S.A., Meiji Holdings Co., Ltd., and national dairy cooperatives, shape the competitive landscape through diversified product portfolios and well-developed distribution channels.

Key Market Characteristics:

- Premium positioning — growing demand for functional and specialized dairy products.

- Health focus — rapid expansion of lactose-free and protein-enriched formats.

- Strong retail integration — partnerships with major retail chains and the convenience-store segment.

- Functional innovation — emphasis on products aligned with healthy lifestyle trends.

- International–local alliances — combining global brand expertise with in-depth understanding of local consumer preferences.

What Is Needed for Further Market Development?

Analysts also outline strategic steps for different stakeholders within the ecosystem.

Governments

- support for dairy infrastructure and cold chain development;

- tax incentives for investment in processing;

- simplification of certification procedures and harmonization of standards;

- school milk programs and support for cooperatives.

Industry Associations

- quality standards and certification systems;

- promotion of the nutritional value of dairy products;

- development of professional education and dissemination of best practices.

Processors

- investment in R&D

- development of lactose-free and functional products;

- implementation of digital traceability and quality control systems.

Retailers and Distributors

- diversification of sales channels;

- expansion of e-commerce;

- deployment of modern cold-chain logistics.

Investors

- financing capacity expansion;

- support for innovative startups;

- strategic market consolidation.

Key Takeaway

The global dairy market maintains steady, moderate growth. The main drivers remain protein-based nutrition, functional formats, and expanding consumption across Asia.

Despite competitive pressure from alternative products, dairy continues to serve as a fundamental source of high-quality protein and calcium in the global diet.

Source: Fact.MR