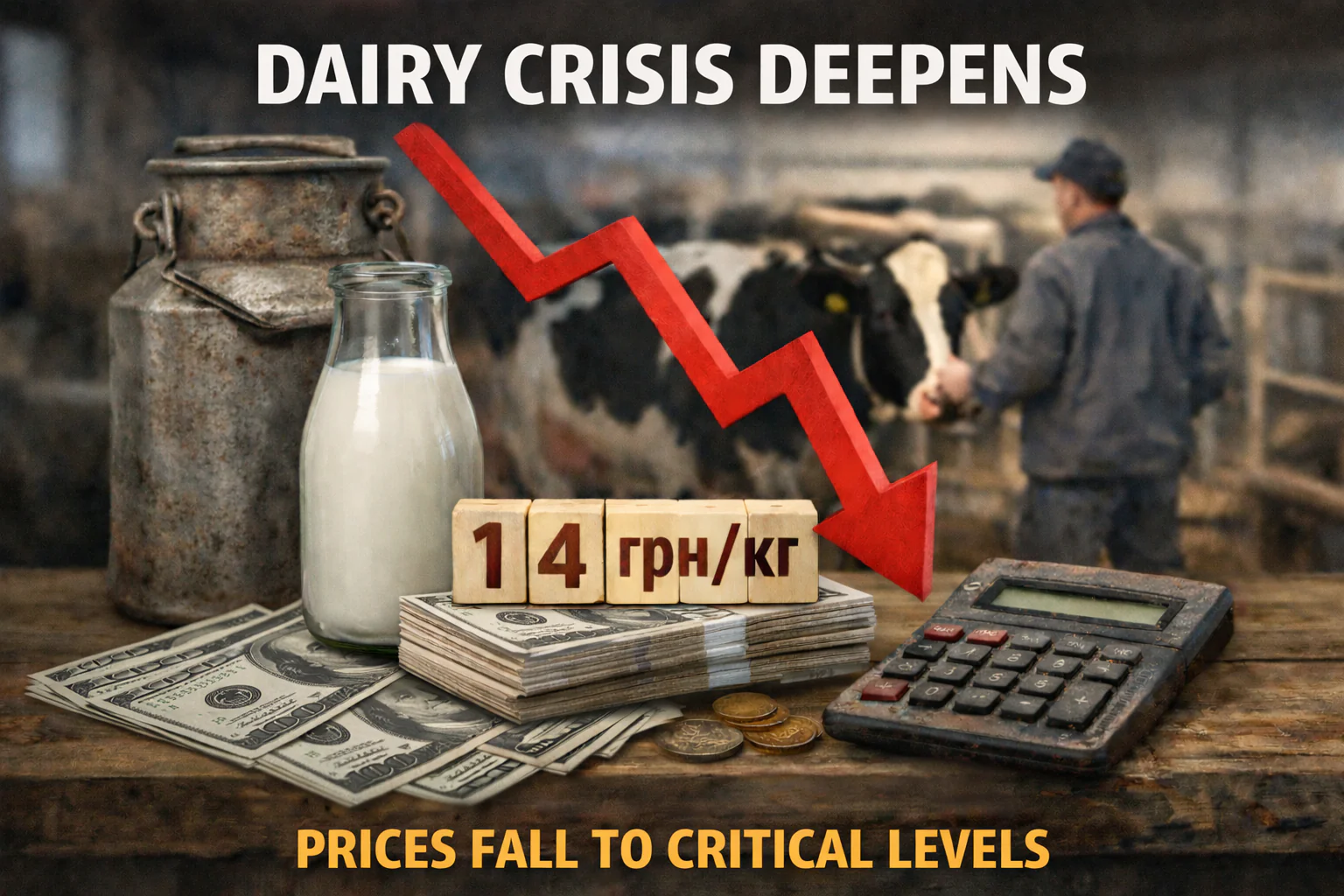

According to Latifundist.com, since the beginning of February most dairy processors in Ukraine have reduced farmgate prices for raw milk to an average of UAH 14/kg (excluding VAT). Market participants note that this is not the bottom: analysts do not rule out a further decline to UAH 12/kg, and in certain periods even to UAH 10–11/kg. For producers who were selling milk at UAH 20–23/kg in 2023–2024, this dynamic has become a serious blow.

Small farms are the most vulnerable under these conditions, as they have effectively lost the ability to operate profitably and maintain their herds.

UAH 14/kg — a critical threshold for farmers

According to Hanna Lavreniuk, CEO of the Association of Milk Producers, the level of UAH 14/kg is a critical threshold for many small and medium-sized farms. If the market does not send positive signals in the near future, some farms may stop preparing feed, finish feeding livestock with remaining stocks, and shut down operations, sending cows to meat processors.

Discussion of the situation has triggered a sharp reaction within the professional community. Farmers complain about pressure from EU imports, suspect processors of coordinated price reductions, and emphasize that it is impossible to “pause” a dairy farm temporarily — once exiting dairy farming, most producers do not return.

The crisis is systemic

Maksym Zalizniak, CEO of Alfa Food Impex, notes that for the first time in many years the crisis has reached the very foundation of the sector — raw milk production. According to his estimates, farms with 100–200 cows are operating at a loss, while even large commercial farms with more than 1,000 cows are balancing on the edge of break-even. He sees structural changes as the way out — business concentration and closer integration of production with processing.

How small farms survive

Kateryna Skrylnyk, owner of a family farm in Poltava region, confirms that the farmgate milk price has long been below the break-even point. A year ago, the farm had more than 100 cows; today, only 15 remain. Survival is made possible by craft, cheese production, and additional income from the beef segment.

In addition to low prices, farmers are under pressure from:

- new animal welfare requirements coming into force in 2026;

- high equipment costs and low payback for small farms;

- expenses for generators due to energy risks;

- limited access to credit and state support;

- difficulties with herd renewal;

- climate risks and feed shortages.

Taken together, these factors are forcing small farms to massively reduce herds or exit the sector.

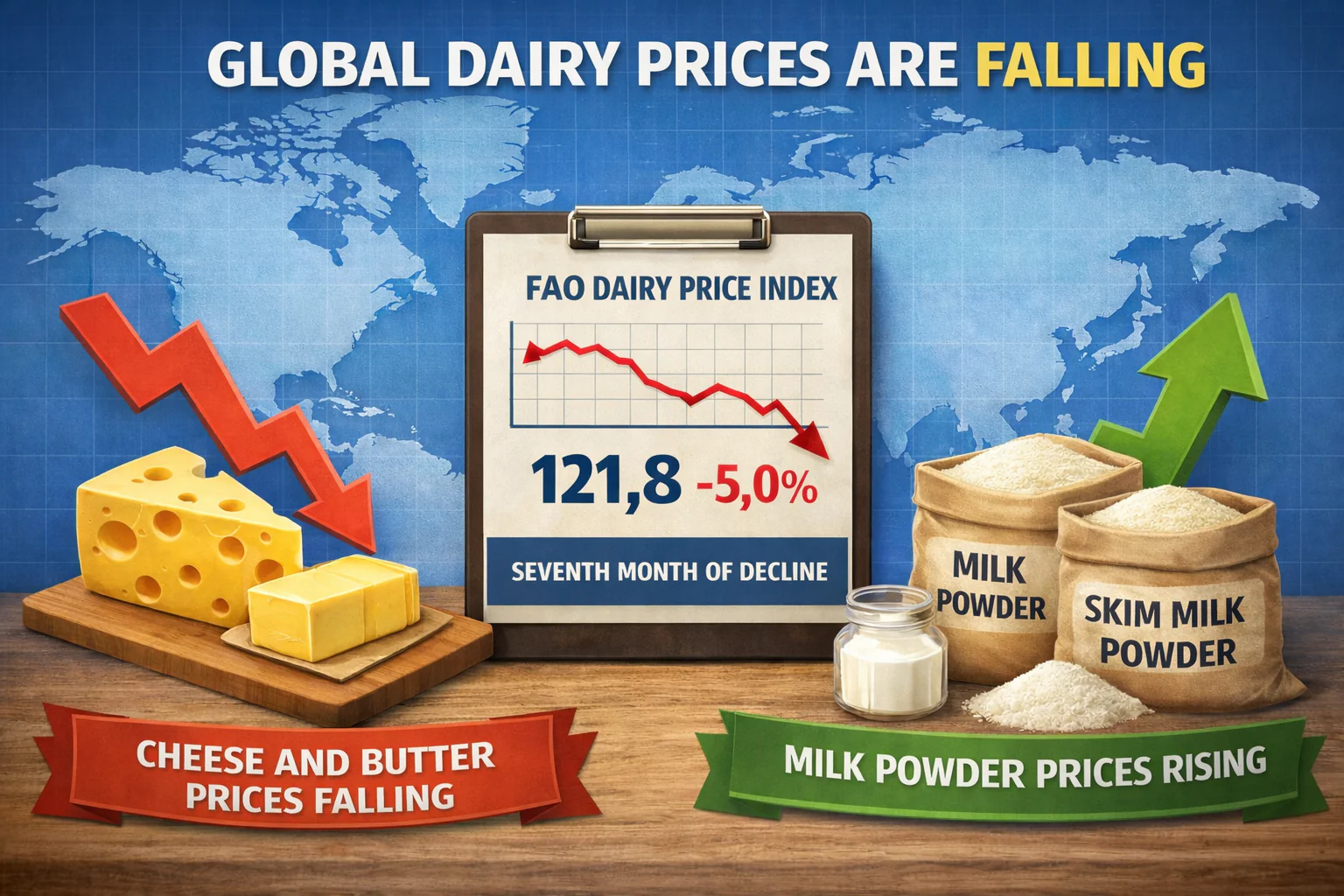

Why prices may fall even further

Dmytro Solomakha, director of the Peremoha farm, notes that UAH 14/kg is not the bottom. The Ukrainian market reacts to global conditions with a lag of 3–6 months. After the collapse of prices for butter, milk powders, and cheese on global exchanges, the decline inevitably reached raw milk as well.

According to him, the key factor has been milk overproduction following the deficit of 2024. Until warehouse stocks are reduced, there are no grounds for price recovery.

Who will remain in the market

Arsen Didur, Executive Director of the Union of Dairy Enterprises of Ukraine, believes this is not a case of processor collusion but rather global market trends at work. Under such conditions, some producers will inevitably leave the market.

Small farms with 100–200 cows, according to experts, will go through the most painful phase of market “cleansing” over the next 6–12 months.

Waiting it out is not an option

Experts agree on one thing: the crisis will last at least six months to a year, and recovery is possible only after a physical reduction in herd numbers and overall milk production. Those who manage to hold on now will have a chance to compensate for losses in the next growth cycle.

Source: Latifundist.com